,

About

Our Unique Approach

+ CASALANA Is a real estate investment group focused on commercial, income-producing multifamily, residential, and special purpose

real estate throughout the Southeast U.S. with a specialty and track record in South Florida .

+ Our business model is focused on identifying “value-add” opportunities in markets exhibiting fundamentals for continued growth through demographic change, municipal and cultural initiatives, as well as marked signs of development and gentrification.

+ In other words, we identify the direct “path-to-progress” and seek to position ourselves within it.

The Casalana Advantage

+CULTURE+

Family owned business with a dedicated commitment and track record of growing personal wealth through wise Real Estate Investments for private clients

+STRATEGY+

Asset & portfolio acquisition, Valuation and Cash-Flow analysis, optimize exit with proper timing and strategy

+OPERATIONS+

Planning, budgeting, risk mitigation, appraisals, LEGAL ownership strategy, accounting (tax planning)

Our Track-Record

+ Casalana - combines the experience of 25 years of Real Estate Investing consistently identifying the best opportunities regardless of market conditions

+ Since 2003 our projects have consistently performed significantly above the average market returns

+ Our ability to identify, negotiate, and close on value-add properties sets us apart

(our established network of lenders, brokers, attorney’s, and closing agents facilitate these deals)

+ We have structured multiple Portfolios and have raised Funds Internationally (we can help with the EB5 Visa )

+ Experience Managing and Investing in multiple markets outside of SFL

Our Process

Market

Knowledge

Defining Value

through Deep

Analysis

Risk Assessment

and Strategic

Decision

Market Knowledge

We commit extensive resources to track data and identify the trends in markets we’ve identified as "optimal growth" opportunity. Through the utilization of third party data services and years of established relationships with Brokerages, Property Managers, & Developers we immerse ourselves in the dynamics of The Real Estate Industry on a day-to- day basis.

Defining Value

In an up, down, or volatile market we strive to always identify the key opportunity’s available; to make sound, fundamentally driven investments in good property. It is not always the “numbers on paper” that define an opportunity, we look to find a unique approach

if so provided. Sometimes an opportunity is straight forward and sometimes value is hidden in the potential of an asset.

Identifying Risk

Risk is an inherent factor in any type of investing. It is through the identification of risk in which we can strategically utilize our experience to minimize loss of value and maximize the creation of it. We identify conservative risk’s with VALUE ADD dynamics. If we determine that the risks is not suitable for our client we will pass on the investment until we identify the best risk! HANDS ON!!

Our Philosophy

Real estate investing is a proven method of wealth-building, at Casalana we specializes in acquiring the best assets for the best value without paying premium. We negotiate the best deals as a result of our combined 25 years of Market Expertise. We manage all portfolios in-house to relieve Investors of the headaches of managing their own units. As we scale our portfolio size we achieve a considerable savings on property management and other fees by reaching economies of scales.

Besides the safety of cash-flowing real estate we achieve higher returns by studying and pursuing Markets where we project a more favorable equity upside on a 5-10 year investment horizon (un-saturated Markets). When we account for the equity and annualize our returns our average IRR % performance is consistently better than industry standards.

As a well-run private equity fund we eliminate unnecessary fees by acting as the real estate operator — investing in properties directly and serving investors personally, rather than going through middleman. Our winning formula is negotiating the right price for acquisitions while maximizing growth potential. We are skilled at finding value and limiting risk; bringing our investors superior returns.

Asset/Investment Classes

Retail

Objective: Class A – D

Target Product: Prefer well located single and multi tenant properties either stabilized or with value add potential.

Occupancy: 80% for Core properties; no leasing requirement for value add.

Initial Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

ProForma Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

Project IRR Expectations: 15% and up depending on market, cap-ex requirements, credit profile of tenancy

Multi Family

Objective: Class A – B

Target Product: Prefer well located in-fill garden & midrise complexes. Competitive unit sizes and amenity packages.

Occupancy: 90% for Core properties; no leasing requirement for value add.

Initial Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

ProForma Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

Project IRR Expectations: 15% and up depending on market, cap-ex requirements, credit profile of tenancy

Office

Objective: Class A – C

Target Product: Prefer well located in-fill with primarily medically related tenancy

Occupancy: N/A

Initial Cash on Cash Yield: 10% and up

ProForma Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

Project IRR Expectations: 20% and up depending on market, cap-ex requirements, credit profile of tenancy

Special Use/Land

Objective: N/A

Target Product: Prefer well located properties with favorable zoning to increase value by changing use or increasing density.

Occupancy: N/A

Initial Cash on Cash Yield: N/A

ProForma Cash on Cash Yield: Varies depending on market, cap-ex requirements, credit profile of tenancy.

Project IRR Expectations: 25% and up depending on market, cap-ex requirements, credit profile of tenancy

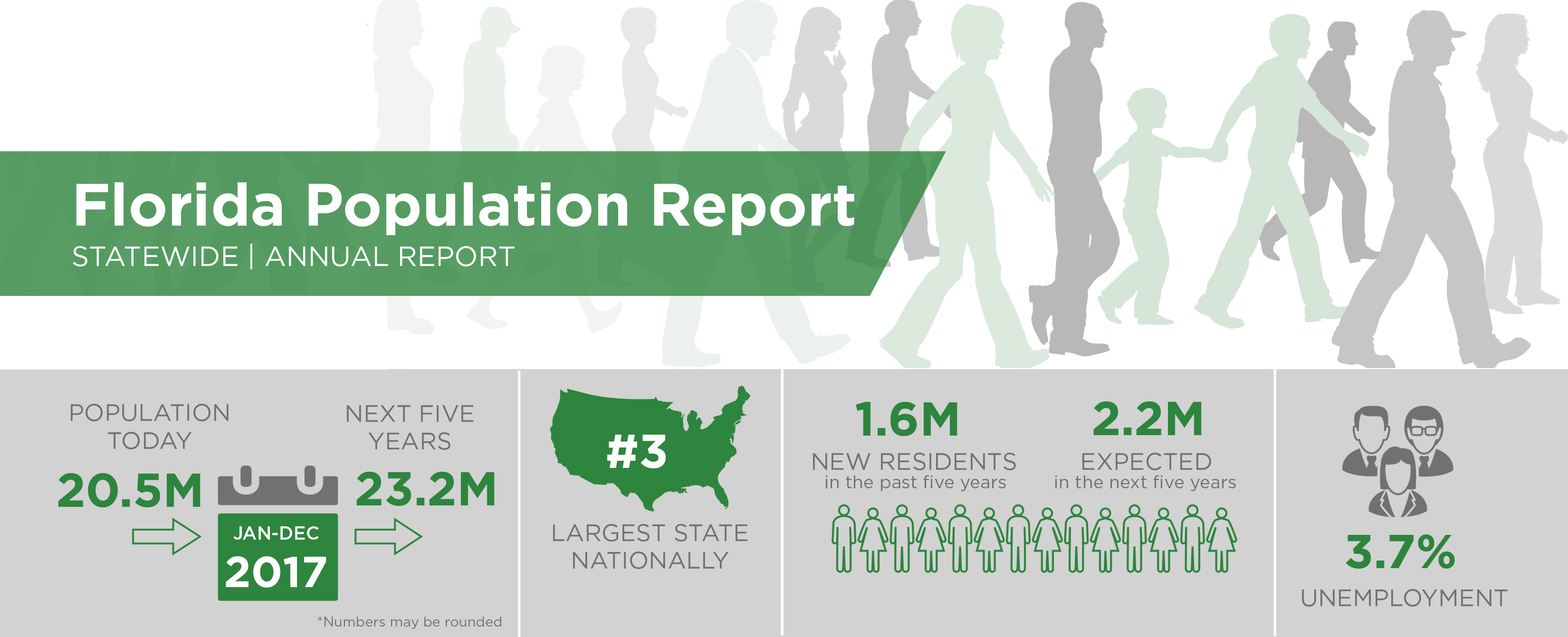

Geography

We intend to focus on properties located in Florida, with a primary focus on the South Florida and Orlando markets where we have an established market presence, or market knowledge and access to potential investments, as well as an ability to efficiently direct property management and leasing operations. Our initial target markets will be growth markets with strong demographic growth, such as employment, household income, and economic diversity.

Additionally, we may pursue properties in other markets demonstrating strong fundamentals and opportunities to acquire properties at prices below replacement cost. Economic and real estate market conditions vary widely within each region and submarket, and we intend to spread our portfolio investments across multiple sub-markets in a careful, selective, and strategic manor.

Research

The last 10 years have been tremendous growth for the US economy. Since the 1920’s South Florida has been subject to hyperbolic speculation and over reaction by investors and developers which have created many opportunities along the way. In todays market we study the trends defining the “winner’s” in the marketplace and unique development opportunities, which is where we choose to focus. We look for fundamentally sound opportunities to take advantage of high growth rates in vetted pockets of growth throughout the Southeast U.S., specifically in Florida. With favorable tax conditions, great weather, and booming tourism Florida has been slowly luring more and more residents nationally and internationally. As you can see bellow, Florida’s population is largely concentrated in the “Millennial” “Gen X”, and “Gen Y” demographic which is where the majority of consumer spending is growing:

Proven Results

• We have experienced the growth in Florida first-hand; and have correctly targeted these specific markets with substantial growth.

• We follow the money trail and have successfully completed investment projects in the face of multiple market dynamics.

• Our primary focus is on retail, office, an income producing residential assets

• We also target repositioning opportunities for land or special purpose buildings with development potential.